kentucky inheritance tax calculator

The Kentucky inheritance tax is a tax on the right to receive property upon the. Kentucky is a reasonably friendly tax state.

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

. It is sometimes referred to as a death tax Although states may impose their own. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Your average tax rate is 1198 and your marginal.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Overview of Kentucky Taxes.

The tax to Class C beneficiaries for gifts of that size is calculated at 28670 plus 16 of the amount over 200000. Aside from state and federal taxes many Kentucky. Kentucky Income Tax Calculator 2021.

The states average effective. The tax rate is the same no matter what filing status you use. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The highest property tax rate in the state is in Campbell County at 118 whereas the. In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median. Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now.

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Your household income location filing status and number of personal.

Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. The inheritance tax in this example is 76670. Failure to File or Failure to Furnish Information - Five 5 percent of the estimated tax due assessed by the Department of Revenue for each 30 days.

Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed. Class b beneficiaries are subject to an inheritance tax ranging from 4 to 16 class c beneficiaries are subject to an inheritance tax ranging from 6. Kentucky imposes a flat income tax of 5.

The minimum penalty is 25. 92A200 6-16 Commonwealth of Kentucky DEPARTMENT OF REVENUE KENTUCKY INHERITANCE TAX RETURN Requirements for use of this returnThis return is to be filed.

How To Calculate Inheritance Tax 12 Steps With Pictures

Capital Gains Tax What Is It When Do You Pay It

How To Calculate Inheritance Tax 12 Steps With Pictures

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Capital Gains Tax Calculator 2022 Casaplorer

Is There An Inheritance Tax In The Usa Expat Tax Professionals

Tax Calculator Mccracken County Pva Bill Dunn

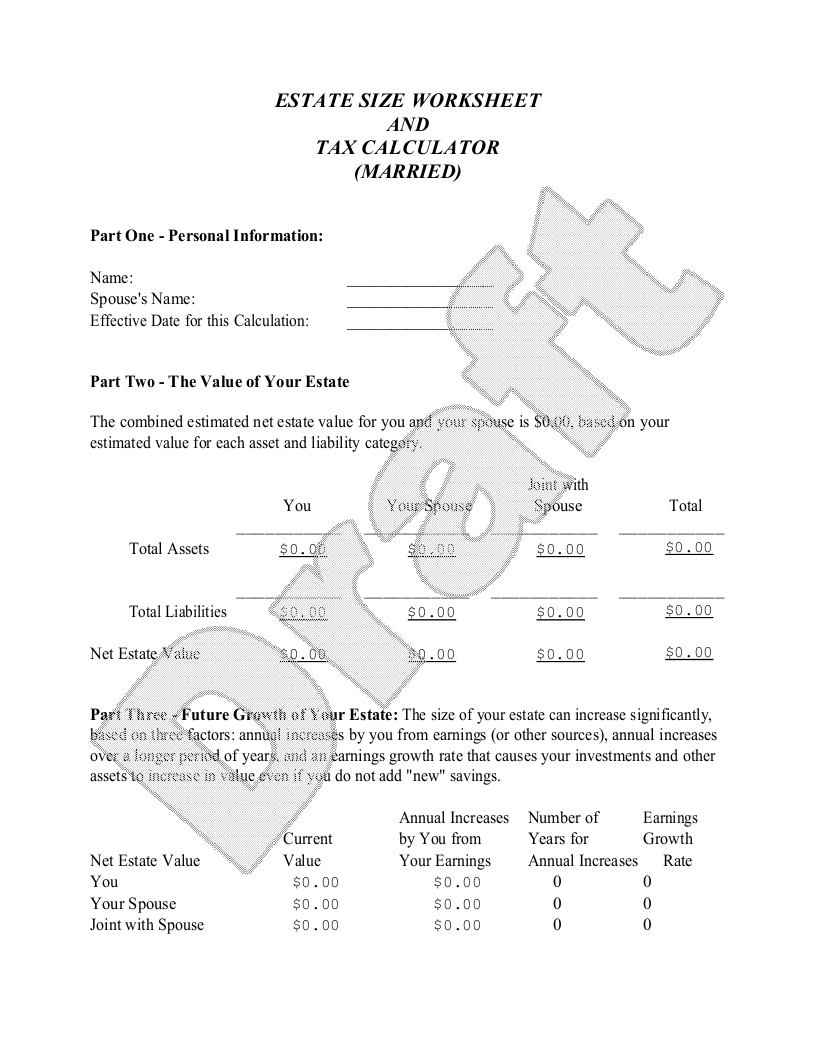

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Inheritance Tax 2022 Casaplorer

Inheritance Tax On House California How Much To Pay And How To Avoid It

How Much Money Can You Inherit Tax Free Inheritance Tax Calculator Banks 2022 Daily4mative

:max_bytes(150000):strip_icc()/tax_calculator-5bfc3233c9e77c0051810349.jpg)